UK Housing market

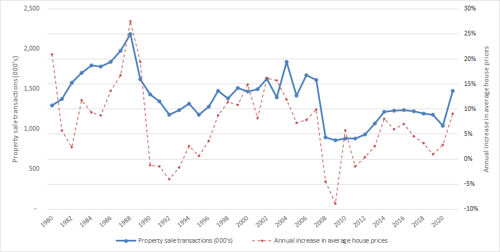

UK Housing transactions and the annual increase in average house prices are shown in the chart below:

Overall house transactions remain relatively low versus historical averages. In H1 2022, the number of property transactions fell by 29% compared to H1 2021, the stamp duty holiday in H1 2021 having considerably boosted the market. However, property transactions still trended above pre-Covid-19 levels, having grown by 8% compared to H1 2019.

House prices continued to increase in H1 2022, with average house prices having increased by 10% year-on-year, similar to the increases seen throughout 2021. This has slowed in H2 2022 due to fears of recession and the rising cost of living.

Despite inflationary pressures and further national and geopolitical uncertainty, the level of consumer demand for housing remains strong, supported by UK full employment, high levels of household savings, and, for those who are subsequent movers, rising housing equity levels over recent years. Lenders also have strong liquidity levels, meaning mortgage availability is now close to pre-pandemic highs, thereby helping market activity to remain healthy.

Although interest rates have risen and will most likely continue to rise over the next 12 months, current interest rates remain near historical lows. We expect this to continue to stimulate re-financing activity. We are confident that this, coupled with strong demand for housing, will continue to drive sustained transaction activity in the mortgage market.

UK mortgage intermediary market

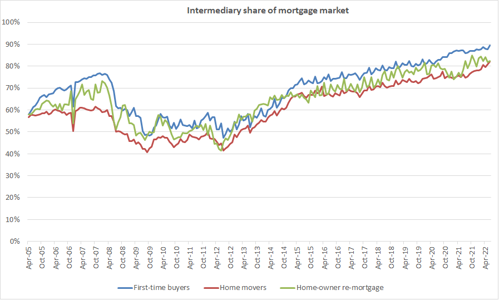

The share of UK residential mortgage transactions via intermediaries since 2005 (excluding buy to let, where intermediaries have a higher market share, and product transfers where intermediaries have a lower market share) is summarised below:

The increase reflects how consumers increasingly want choice, advice, and support in making major financial decisions. The increase in intermediary market share also reflects the lower footfall in bank and building society branches, a change that was accelerated in part by Covid-19. We expect the current levels of intermediary market share to remain stable in the short term.

UK Protection Market

It was estimated by Swiss Re in May 2017 that the protection gap in the UK was £2.5 trillion. This represents a considerable opportunity for MAB as our advisers are not only focussed on getting customers into their new homes, but also keeping them there if an unexpected event occurs in their lives.