Own your future

Ever feel like you’re missing out by not owning your own home? You’re not alone.

In fact, we've discovered that UK renters could potentially save nearly £340k if they chose to buy rather than rent over a 30-year period.

It's stats like this that drive home why 73% of renters feel like their money is "going down the drain", and why 56% would seriously consider buying if mortgage repayments matched their rent.

Ever thought about buying, but don't believe you're in the financial position to do so? It might surprise you to hear that homeownership is well within reach - especially compared to this time last year. With more choice of mortgage products on the market than ever before, first time buyers are in an increasingly strong position when it comes to getting on the property ladder.

By figuring out how much you could borrow, the kind of home you could afford, and what your repayments could look like, you can cut through the myths and misunderstandings and kickstart your homeowning journey with confidence.

[1] Based on research by Mortgage Advice Bureau that, if invested gradually, the long-term savings from homeownership could potentially deliver returns of up to £338,170 over three decades.

Ready to break the rental cycle?

From taking those first steps to unlocking your front door, uncover your mortgage costs from start to finish with our handy calculators:

Borrowing calculator

Enter your income and the amount you could raise for a deposit to see how much you could borrow.

Repayment calculator

Curious about what your monthly mortgage payments could look like? Our repayment calculator will give you a clearer picture.

I feel like I'm ready - what do I need to get started?

If you’re happy with the amount you can borrow and you’re comfortable with what your monthly payments could look like, you're well on your way towards taking that first step onto the property ladder.

There are a few things you'll need to think about before you speak to a mortgage adviser, and we've broken these down for you into three simple steps:

When you buy a house, you typically don't pay the entire amount in cash. Instead, you get a mortgage (loan) to cover the majority of the purchase.

The deposit is the portion you pay yourself, out of your own savings, and this is typically 10% of the property's price. However, if you don’t have this amount, it doesn’t mean your homeownership dreams are scuppered.

Many options are available to help you get onto the property ladder, including first time buyer schemes and specialist solutions that allow you to pay a smaller deposit (or even none, in some cases) to get a mortgage.

Getting a mortgage is a big step, but remember there are other essential costs beyond your deposit. You'll need to budget for things like conveyancing fees (the legal work), surveys (to check the property's condition), and other moving expenses. While you may be exempt from Stamp Duty Land Tax as a first time buyer, you will have to pay this if your property is more than £300k. These costs can quickly add up, so it's smart to factor them in from the start so there aren’t any nasty shocks along the way.

With your finances, deposit, and documentation all in order, you're now ready to speak to a mortgage adviser. They have the experience and knowledge to help you navigate the entire mortgage process from start to finish.

Not only will an adviser help find the right mortgage for your budget and needs, but they also have access to exclusive deals and incentives you wouldn't be able to secure by going directly to a bank.

How we can help

At MAB, we're here to get you comfortable, cosy, and safe in your own home.

We're a group of people who are passionate about untangling the web of mortgages and homeownership. With branches all over the UK, we understand the ins and outs of your local property market, and will help you find a solution that aligns perfectly with your needs.

Our expert advisers can answer any questions you have at whatever stage of your journey you’re on, whether it's over the phone, virtually, or at one of our branches.

Important information

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The fee is up to 1% but a typical fee is 0.3% of the amount borrowed.

How much could you save by buying compared to renting?

Rent and mortgage payments differ based on your location. Check out how much you could potentially save based on where you're looking to live:

The figures above are based on research by Mortgage Advice Bureau, looking at the average of the total saved when buying compared to renting over a span of 30 years, as well as the total missed financial opportunity if you chose to remain renting.

Not quite ready to speak to an adviser?

Dreaming of owning your home instead of renting? Our expert newsletter is designed to help you make that leap. We'll equip you with invaluable information, practical tips, and essential tools, so you can navigate the path to homeownership with clarity and confidence.

Common mortgage myths

It's easy to feel overwhelmed by what you think you know about deposits, credit scores, family support, or even visa restrictions. However, many of the hurdles first time buyers anticipate aren't as high as they seem. Here are some common misconceptions…

Not necessarily. Many buyers in the UK usually have a deposit between 5 and 10% of the property’s value. For example, if you wanted to buy a property valued at £250,000, you’d need £25,000 to meet your 10% deposit. Some lenders have begun to offer a 100% mortgage, meaning you don’t need a deposit. In any case, always make sure to speak to a mortgage adviser and do your research.

Homebuyers come in many forms, including those with families and dependants. Many of these buyers manage to get a mortgage and move into their new home. While having a child or dependant may impact your affordability, lenders won’t be more cautious.

It’s often possible to get a mortgage in the UK if you have a Tier 1 or Tier 2 (now known as a Skilled Worker) visa. However, the process can be slightly different and you might face specific criteria compared to a UK citizen, or someone with Indefinite Leave to Remain (ILR). We understand that this can feel complicated, but fear not: an adviser will be able to take you through the process from start to finish.

Mortgage rates change depending on what’s going on in the wider world, and it's smart to consider their impact on your budget. The good news is that even when rates seem higher, there are still many options to explore to find a mortgage that works for you. Also, you can change the term of the mortgage over a longer period of time to lower the payments. This is where the value of using a mortgage adviser really comes into its own, as they’ll shop around to find you a deal that aligns with your budget.

A less-than-perfect credit score or a patchy financial history can feel like a major roadblock to getting a mortgage. However, it's not always a definitive "no”. Lenders look at various factors to assess how financially responsible you are, and there are products out there designed for those with past financial challenges. But, don't let your credit history stop you from exploring your options. A mortgage adviser can help you understand what's possible and guide you towards solutions that might work for you.

Some first time buyers turn to their family for financial support to fund their deposit. This is known as a ‘gifted deposit’. However, there are a number of family assist options, where relatives can help by providing security (savings, or equity in their own home). You could also have a family member named on the mortgage without being on the property deeds (known as a joint borrower, sole proprietor mortgage). Speak to an adviser about the range of family support options available.

It's a common misunderstanding that being self-employed puts a mortgage out of reach, but that's simply not true. While it might have been more challenging in the past, lenders are increasingly open to self-employed applicants, even with as little as one years’ worth of accounts. The key is demonstrating consistent income and financial stability. An adviser will talk you through everything you need, and tailor your mortgage application to lenders who understand the nature of self-employed work.

Having a mortgage is likely to be one of the biggest financial commitments you’ll make, and with that comes the risk of becoming unable to repay it if your circumstances change. To ensure you can stay in your home, we offer a range of protection insurance options to fit your needs, and offer you valuable peace of mind. These include life insurance, income protection, critical illness cover, and more - all of which an adviser can talk you through.

Make saving, planning, and tracking easier

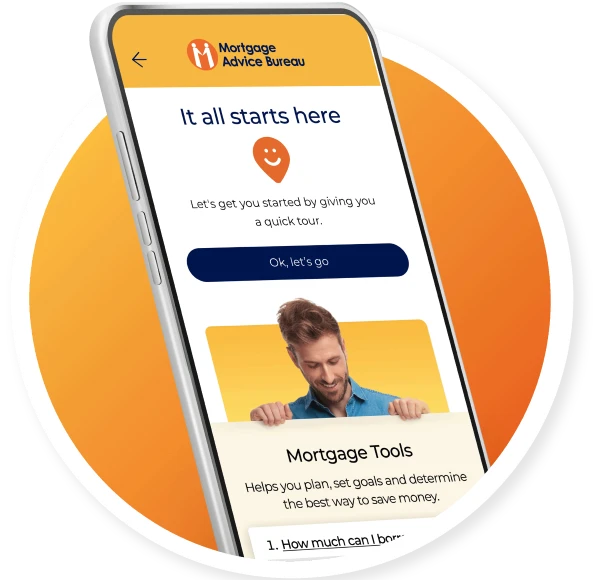

There’s a lot to juggle when buying your first home, but the My MAB app can help simplify the process and keep you on track – acting as your own digital mortgage coach.

This handy and easy-to-use app is designed to help you set savings goals, review what you can truly afford, and track every step towards your homebuying journey with ease. It’s also packed with tips and advice written by experts to answer any burning questions you may have at every stage of buying your new home. Better yet, it’s totally free and can be downloaded from the App Store and Google Play - try it today!

From daydream to doorstep

When it comes to being tired of paying rent, you're not alone. We've helped countless individuals and families, just like you, to break free of the renting cycle and get onto the property ladder…