The dream of owning a home is something that many aspire to, and while it may seem like there are a lot of steps involved in the process, with the right tools the homebuying journey can be effortless.

The MyMAB app is here to help you simplify the process and make your path to homeownership more accessible.

Let’s take a closer look at some of the key features of the app and how it can transform your homebuying journey.

Work out how much you can borrow

With our affordability tools, you can calculate how much you’re able to borrow, making the task of budgeting effortless and pain free. We’ll look at what you’re able to afford, and give an estimate of your monthly mortgage repayments.

Affordability calculator

Affordability is a major component of the mortgage process and it's important to have an understanding of where you're at in your journey. Do you need more of a deposit? How does your credit score look? Do your incomings and outgoings make sense?

This and more goes into working out your affordability. We've made the process super simple by putting together a handy dandy calculator in the app to get you started.

Deposit tracker

Knowing how much you need for your deposit is crucial in when planning your financial journey. The app provides an easy to use deposit tracker, which takes into account the property's value, lending criteria, and your financial situation to work our the minimum required. From there, you can use our handy slide tools to tailor the results to your circumstances.

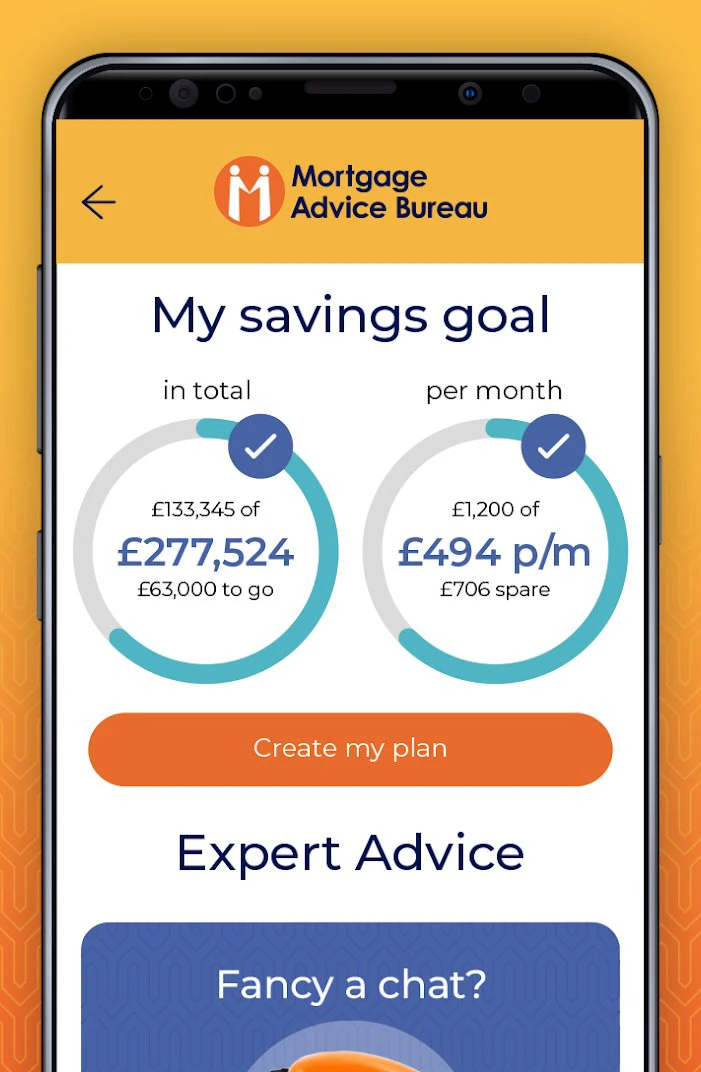

Savings tracker

One of the most challenging aspects of buying a house is saving for a deposit. Our app features a smart and user-friendly savings tracker that helps you set realistic savings goals and monitor your progress. By inputting your income, expenses, and desired timeline, the app will work out not only how much you need to save each month, but how close you are to your goal.

Timelines

Setting a clear timeline is essential when embarking on the journey towards homeownership. The MyMAB app supports you with this by laying out clear dates and milestones to work towards. Not only that, but it lays out a full step-by-step journey for you to take.

Step-by-step journeys

Perhaps one of the most valuable features of the MyMAB app is its guided journey process. The app offers a step-by-step checklist to take you from square one to that final handshake.

From evaluating your financial readiness to connecting you with mortgage advisers, the app is the planning tool for you.

Read our expert advice articles

Browse our library to answer any of your home buying questions. We know you have a bunch of questions about buying your new home, and our expert advice articles can answer the lot.

Knowledge articles

Buying a home involved navigating through various processes and jargon. The app offers a wealth of knowledge articles to cover essential topics related to homeownership and beyond.

From understanding different mortgage types to grasping the intricacies of surveys, these articles are your guide through the noise. Think of it like an encyclopaedia in your pocket!

Push notifications

Staying up-to-date with the latest trends, market conditions, and financial news is crucial when making important monetary investments. The app can keep you informed, delivering real-time news and updates relevant to your situation and the overall housing market.

Everything we share is designed to keep you informed and involved.

Unlocking the power of digital tools

The MyMAB app is a game changer for prospective buyers and we're always working on it to ensure it's the best it can be.

With powerful features such as savings trackers, affordability calculators, and knowledge articles, the app is a robust all-rounder than can help you transition from renting to homeownership seamlessly.

By using the MyMAB app, you can confidently take control of your finances and make your dream of home ownership a reality.

So, why wait? Download the MyMAB app today and try it out for yourself. The best part? It's completely free.

Important information

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend on your circumstances. The fee is up to 1% but a typical fee is 0.3% of the amount borrowed.

Related Articles

Using our MyMAB app to track your savings

Life is proving expensive right now, and we’re all trying to tighten our pursestrings wherever we can. That’s where the MyMAB app comes in.

< 40 views | 1 year ago

How do mortgage affordability assessments work?

It's important to go through affordability checks to make sure you can comfortably afford to repay your mortgage. Here's how they work.

230 views | 6 months ago

Assessing your affordability: getting your finances in tip-top condition

Managing your finances is an essential life skill that, if conducted properly, can help you on your way to achieving your financial goals.

< 30 views | 1 year ago

No posts currently available