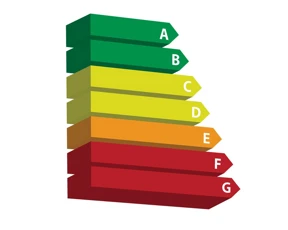

This is reflected in Energy Performance Certificates (EPCs), which grade properties from A (most efficient) to G (least efficient). While properties with high EPC ratings are generally more desirable, you might come across an attractive option with a lower rating.

So, should you consider buying a low EPC-rated property? Here's a breakdown of the pros and cons to help you decide.

Pros of buying a low EPC-rated property

Lower purchase price

Properties with low EPC ratings are often priced lower than their more energy-efficient counterparts. This could be a significant advantage, especially in competitive housing markets.

Potential for improvement

Low EPC ratings represent an opportunity to make energy-saving upgrades, increasing the property's value and reducing your running costs in the long run. You might even qualify for government grants, green mortgages, and financial incentives for green renovations.

Uniqueness and character

Older properties with lower EPC ratings often have unique architectural features and character that might not be found in newer, more energy-efficient builds. If you value charm and history, this could be a major draw.

Cons of buying a low EPC-rated property

Higher energy bills

The main drawback is the likelihood of higher energy costs. Poorly-insulated homes with inefficient heating systems require more energy to maintain comfortable temperatures, translating to higher monthly bills. With rising energy prices, this can significantly impact your budget.

Resale value

When you eventually sell, a low EPC rating might deter potential buyers who prioritise energy efficiency and lower running costs. This could limit your pool of interested buyers and potentially affect your asking price.

Environmental impact

Low EPC ratings indicate a larger carbon footprint, contributing to climate change. If environmental responsibility is important to you, a low rating might not align with your values.

Future regulations

Governments are increasingly implementing stricter energy efficiency regulations for properties. Meeting these standards in the future might require costly renovations, adding to the long-term financial burden.

What are green mortgages?

Green mortgages reward you for purchasing a property with a high EPC rating or renovating a property with a low EPC rating with the intention of improving the rating. These mortgage products typically offer:

-

Lower interest rates: Enjoy reduced borrowing costs as a reward for your environmental commitment.

-

Cashback incentives: Some lenders offer upfront cashback to help offset the potentially higher purchase price of an energy-efficient property.

-

Larger loan amounts: Certain green mortgages allow you to borrow more, making it easier to afford a sustainable home.

Ultimately, the decision to purchase a low EPC-rated property depends on your individual priorities and circumstances. Consider your budget, environmental concerns, long-term plans, and renovation capabilities. If you're DIY-handy and willing to invest in energy-saving improvements, a low EPC-rated property could be a worthwhile project. However, if energy efficiency and low running costs are paramount, it might be wiser to prioritise properties with higher EPC ratings

Important information

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend on your circumstances. The fee is up to 1% but a typical fee is 0.3% of the amount borrowed.