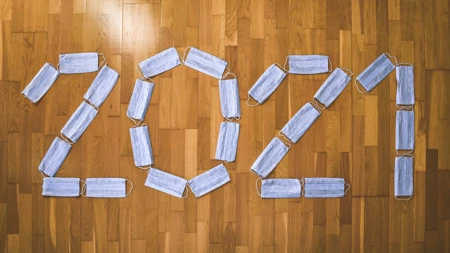

The pandemic has impacted a lot of industries. The property sector is no exception. With the introduction of the stamp duty holiday, virtual viewings and an increase in consumer demand, the industry hasn’t taken as much of a hit as expected.

In fact, demand for houses has remained high, which has been good news for mortgage brokers and advisers. It’s also had an impact on attitudes to mortgage protection. It’s definitely increased interest among consumers.

An increased interest

Since the beginning of the pandemic, protection insurance has seen a spike in interest. The majority of this interest has come from Generation Z.

In fact, ReMark's seventh annual Global Consumer Study (GCS) into life and health insurance found that 51% of Generation Z candidates said their attitudes had changed towards the value of insurance in light of the pandemic.

This renewed interest wasn’t limited to the younger generations, though. Overall the study found around 40% of consumers had changed their minds about insurance as a result of Covid-19.

Some experts suggest this peak in interest has been caused by a popular theme of health and safety in the media. At the height of the pandemic, news channels were (and still are) talking about mortality rates, protection of health, and safety precautions against the virus. This narrative is raising an awareness of protection for the consumer and insurance interest has increased as a result.

Facing the tough conversations

Before the pandemic, mortality and morbidity still felt like taboo subjects. Now that these are dominating the media, people have become more used to these tougher conversations. This has made it easier for mortgage advisers to talk about the cover their clients need.

In fact, people are actively seeking protection advice now. According to a study found in The Guardian, 4 in 10 advisers said they had seen an increase in protection enquiries from existing clients, while 38 per cent had seen an increase from new clients.

Covid-19: a catalyst for the mortgage market

Government policies as a result of Covd-19 have boosted the industry immensely. The stamp duty holiday meant a rise in selling and buying of houses, which in turn meant a significant boost for the mortgage market.

Some professionals in the industry have acknowledged Covid-19 as a huge catalyst for mortgage protection. Clients have a changed attitude towards its value, which has had a big impact on the amount of income protection sales.

A cautious approach

With this spike in interest, consumers have also become more cautious about where they get their information.

Across all industries, it’s always best to get information from the experts. That way, you’ll be guided by professionals who know the ins and outs of the sector, and will be able to apply that knowledge to your specific needs.

Advice from the experts

Though the stamp duty holiday has ended, the boom in the property market hasn’t faded yet. Now more than ever, people need advice from the experts. Whether it’s finding the right mortgage protection for you, getting onto the property ladder or other mortgage advice, our mortgage advisers in Hull are here to help. To make an initial no obligation appointment, get touch today by calling us on 01482 470444 or send us an e-mail.