Without your income, what would your family's life look like? Would they have to make difficult sacrifices to get by? While these questions are hard to consider, it takes just a small amount of time to put the right protection in place. Family Income Benefit offers a solution, providing your loved ones with the financial security of a regular income, should you pass away.

What is Family Income Benefit?

Family Income Benefit, or FIB as it is often shortened to, is a protection policy that pays out a regular income to your family for a set period of time, should you die during the term of the policy.

This is a type of life insurance which pays out an income instead of a one-off lump sum. This income is paid until the end of the policy term, depending on when you die will dictate the amount that the policy will pay out. This is why it’s known as a ‘decreasing term policy’.

The monthly payments your beneficiary will receive are tax-free, and can go towards living expenses that your family may otherwise fall short of if they no longer have your income.

Why you should have it

Picture this: how different would your family’s life be without your wage? Would they have to make any sacrifices such as holidays, family days out, or after-school clubs? Would they have to move to a smaller house in a new area, which would mean starting a new school and making new friends?

Now picture your family having to live through these difficult changes in addition to dealing with the loss of a parent/partner. At a time when you’re at your most vulnerable and find yourself navigating through the grieving process, living in financial difficulty is an extra burden you would not want your family to carry.

By seeking the right advice and getting the right protection policy in place, you can help support your family, even when you’re not physically here.

Our Mortgage Adviser, Dale Knight, explains:

“Family Income Benefit is a policy that enables the family left behind to focus on bereavement and recovery, rather than worrying about paying the bills or selling a family home. You often find people’s focus is on clearing the mortgage, rather than the vulnerable state of mind during the period after loss.”

Who is it for?

Family Income Benefit isn’t just for families with children. If you have anyone who relies on your income in order to pay the bills, then this could be useful to you. It’s worth considering the following:

-

Are you the main breadwinner in your house?

-

Would your partner be able to afford the mortgage and bills without your income?

-

Would your family be able to maintain their current lifestyle without your income?

The cost of Family Income Benefit

Family Income Benefit is one of the most affordable life insurance policies because the amount paid out decreases over time.

Insurers base the monthly cost you’ll have to pay on the likelihood of you making a claim. This is based on the following:

-

Your age - the younger you are, the cheaper it will be.

-

The amount you want paid each month - the higher the amount, the higher the premiums will be.

-

Your medical history - any pre-existing health conditions will mean higher premiums.

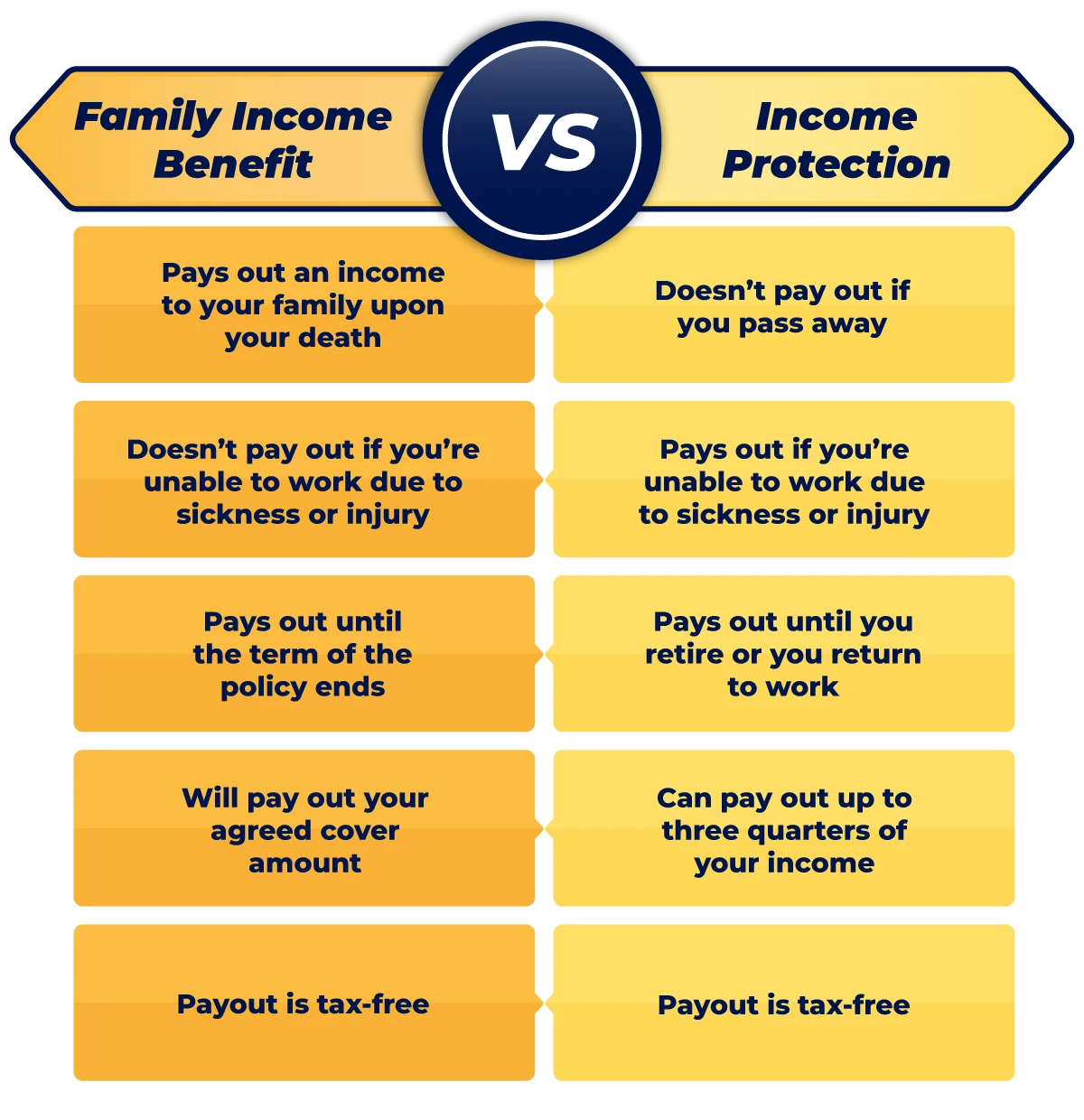

Family Income Benefit Vs Income Protection

Here’s a quick comparison between a Family Income Benefit policy and an Income Protection policy. To highlight the main difference, one will pay out upon death, whereas the other will pay out upon you being unable to work.

Click below to learn more about Income Protection:

Feeling confused?

With so many protection policies around, it can be hard to know which ones are right for you and your family. For instance, some policies pay out monthly amounts, which can be great for affording day-to-day living costs. Others, such as life insurance, pay out lump sums, which is ideal for paying off the mortgage.

Our protection advisers are fully qualified to talk you through each of the policies we offer from our panel of providers. They can help you choose the ones that are going to be most beneficial, should you ever need to make a claim.

Click below to arrange a callback with one of our advisers who can answer any questions you have.

Important information

For insurance business we offer products from a choice of insurers.

Related Articles

Do I need income protection if I’m self-employed?

Self-employed and worried about getting sick? Income protection could be the answer to your concerns. Here’s why.

5 important reasons to get life insurance

Life can be full of surprises, and while we can’t predict the future, we can definitely plan for it. Here are 5 key reasons why you need to get life insurance…

Insurance FAQs

Not sure where to start when looking at insurance? We have everything you need to know.

No posts currently available