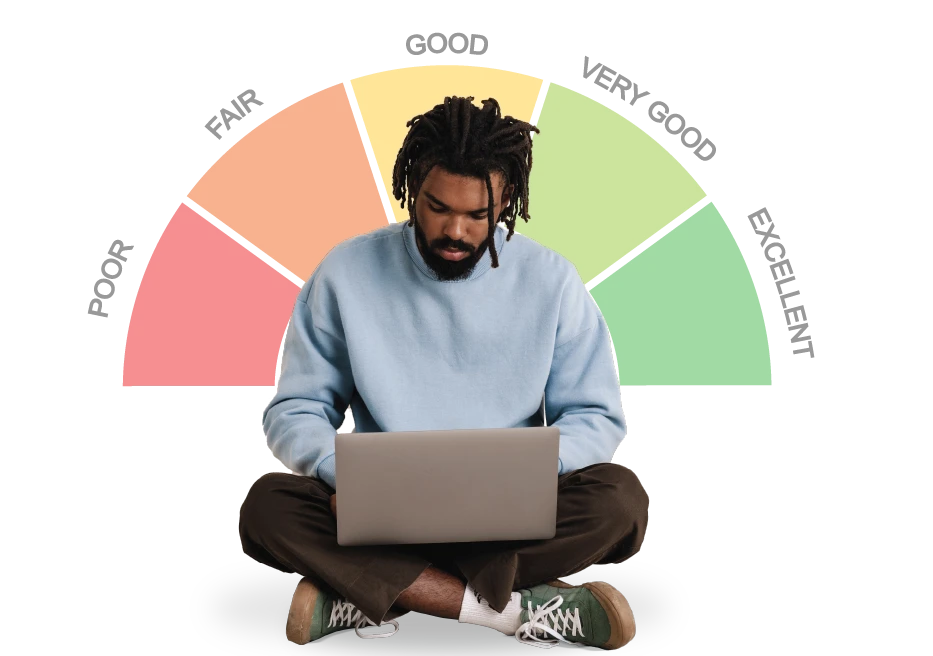

What is my credit rating?

Your credit rating is a three-digit number that reflects your responsibility as a borrower. A bad credit rating can be the result of your borrowing history, credit applications, missed payments and even whether you’re on the electoral register.

It’s likely that lenders will look at your credit history when making a decision about your mortgage and having a poor credit rating can affect the amount you can borrow.

Bad credit doesn’t mean bad options

Having poor credit history doesn’t have to be the end of the road for you dreams of becoming a homeowner, you just have to be a bit smarter about how you go about it.

We’ve pulled together a handy guide and practical tips to help you improve your credit score to strengthen your chances when you sit down with an adviser.

Getting a mortgage with a low credit score

Everything you need to know about getting a mortgage with a low credit score in one place…

By filling out the form below, you'll receive our free guide and bi-weekly emails containing information to help you become a home owner.

Four quick wins to improve your credit score

1. Pay your bills on time

Set reminders, check due dates and arrange Direct Debits to pay your bills on time.

2. Reduce credit card balances

Try to keep available credit and set realistic spending budgets.

3. Don’t open new accounts…

Applying for new credit cards and loans in a short period can lower credit scores.

4. Get on the electoral roll

This validates your identity and can be done quickly on the government’s website.

Important information

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The fee is up to 1% but a typical fee is 0.3% of the amount borrowed.

How much can you afford to borrow?

Enter in a few details about you income and outgoings along with some property information. We’ll search through a pool of over 50 lenders to find an estimate of your mortgage affordability.

Email my results

Interesting in saving your result? Enter your details below and we'll send you this information within an email.

Make sure you check the tick box to stay up to date with the latest mortgage information.

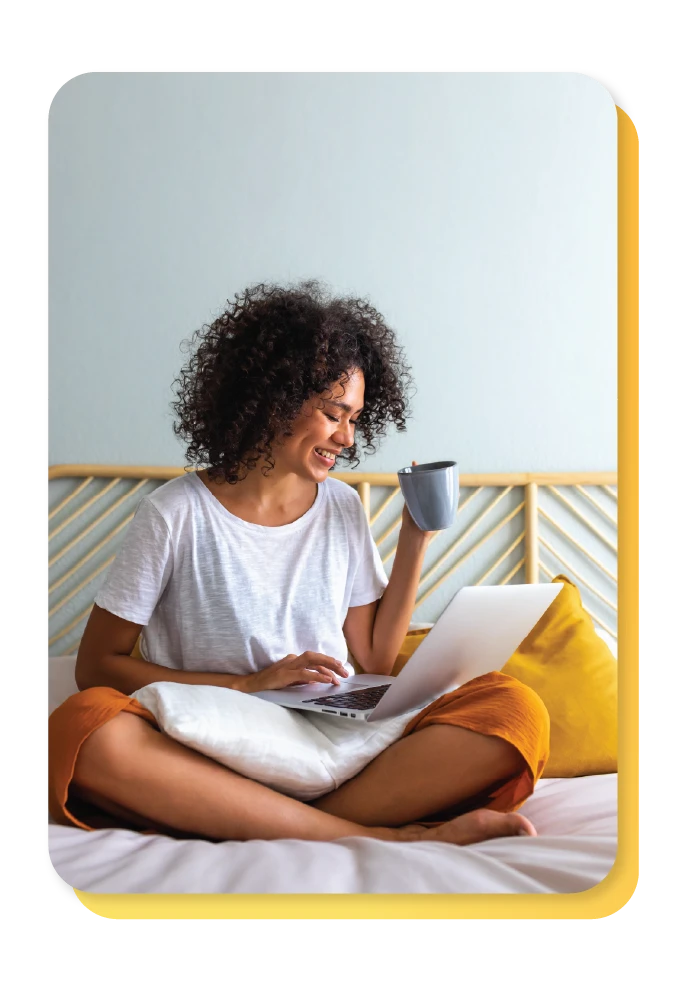

Case study

“We were caught between a rock and a hard place…”

If you’ve got a poor credit score and you’re looking to buy, you’re not alone.

Sam and Samantha were stuck in a loop of being unable to clear debt because they were saving for a deposit and paying rent.

Help only came when they spoke to MAB which found alternative solutions to their problems and helped them move into their first house together.

Ready to get mortgage ready?

Fill out this short form and one of our friendly advisers will be in touch.